THE Canada Revenue Agency (CRA) warns all taxpayers to beware of telephone calls or emails that claim to be from the CRA but are not. These are phishing and other fraudulent scams that could result in identity and financial theft.

THE Canada Revenue Agency (CRA) warns all taxpayers to beware of telephone calls or emails that claim to be from the CRA but are not. These are phishing and other fraudulent scams that could result in identity and financial theft.

People should be especially aware of phishing scams asking for information such as credit card, bank account, and passport numbers. The CRA would never ask for this type information. Some of these scams ask for this personal information directly, and others refer the taxpayer to a Web site resembling the CRA’s, where the person is asked to verify their identity by entering personal information. Taxpayers should not click on links included in these emails. Email scams may also contain embedded malicious software that can harm your computer and put your personal information at risk.

Examples of recent telephone scams involve threatening or coercive language to scare individuals into pre-paying fictitious debt to the CRA. These calls should be ignored and reported to the RCMP (see contact information below).

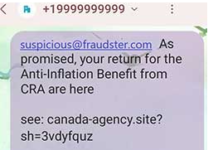

Examples of recent email scams include notifications to taxpayers that they are entitled to a refund of a specific amount, or informing taxpayers that their tax assessment has been verified and they are eligible to receive a tax refund. These emails often have CRA logos or internet links that appear official. Some contain obvious grammar or spelling mistakes.

These types of communication are not from the CRA. If the CRA does contact you by telephone, there are established processes in place to ensure your personal information is protected. Should you wish to verify the authenticity of a CRA telephone number, contact the CRA directly by using the numbers on our Telephone numbers page. For business-related calls, contact 1-800-959-5525 and for individual concerns, contact 1-800-959-8281.

To better equip taxpayers to identify possible scams, the following guidelines should be used:

The CRA:

* NEVER requests information from a taxpayer about a passport, health card, or driver’s license.

* NEVER divulges taxpayer information to another person unless formal authorization is provided by the taxpayer.

* NEVER leaves any personal information on an answering machine or asks taxpayers to leave a message with their personal information on an answering machine.

When in doubt, ask yourself the following:

* Am I expecting additional money from the CRA?

* Does this sound too good to be true?

* Is the requester asking for information I would not include with my tax return?

* Is the requester asking for information I know the CRA already has on file for me?

* How did the requester get my email address or telephone number?

* Am I confident I know who is asking for the information?

* Is there a reason that the CRA may be calling? Do I have a tax balance outstanding?

The CRA has strong practices to protect the confidentiality of taxpayer information. The confidence and trust that individuals and businesses have in the CRA is a cornerstone of Canada’s tax system. For more information about security of taxpayer information and other examples of fraudulent communications, go to www.cra.gc.ca/security.

Anyone who receives a suspicious communication should immediately report it to info@antifraudcentre.ca or to the institution that the communication appears to be from.

For information on scams, to report deceptive telemarketing, and if personal or financial information has been unwittingly provided, go to the Royal Canadian Mounted Police Web page at: www.rcmp-grc.gc.ca/scams-fraudes/phishing-eng.htm.